what is fit on a pay stub

Some entities such as corporations and t. In the View Paycheck column click the pay statement you want to see.

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization

This is the employees required contribution for the Medicare health plan.

. Explanation of Your Pay. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Header abbreviations and codes.

Your pay stub header mainly contains youremployees basic information. This is just a way to save time and space on your pay stub. Look at how you read your pay stub by section.

It covers two types of costs when you get to a retirement age. They are all different taxes withheld. Pay Stub Abbreviations are the abbreviations that you come across on any pay stub.

You are going to see several abbreviations on your paycheck. As complicated as these pay stub abbreviations sound FIT simply stands for federal income tax. FIT Fed Income Tax SIT State Income Tax.

The rate is not the same for every taxpayer. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. At the end of the day you want to know how to read a pay stub to make sure your paycheck is accurate.

Med EE Medicare. Withholding is one way of paying income taxes to the. This is required and the payroll system automatically enrolls employees into the FIT deduction.

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. FIT on a pay stub stands for federal income tax. Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it easier for them to fit a lot of information on a single sheet of paper.

FIT means federal income taxes. What is the difference. FIT is applied to taxpayers for all of their taxable income during the year.

1 medicare and 2 social. These items go on your income tax return as payments against your income tax liability. Also inform yourself about any applicable SIT withholdings.

Click on My Pay. Decoding Pay Stub Abbreviations. They go toward costs needed to run the federal government.

These are the most common ones. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. In the United States federal income tax is determined by the Internal Revenue Service.

Federal taxes happen in tiers with the lowest bracket paying a 10 tax rate and the highest earners paying a 37 tax rate. For a quick-reference version of this web page see the Pay Statement Summary. Know what your FIT tax rate is and memorize the FICA percentage 765.

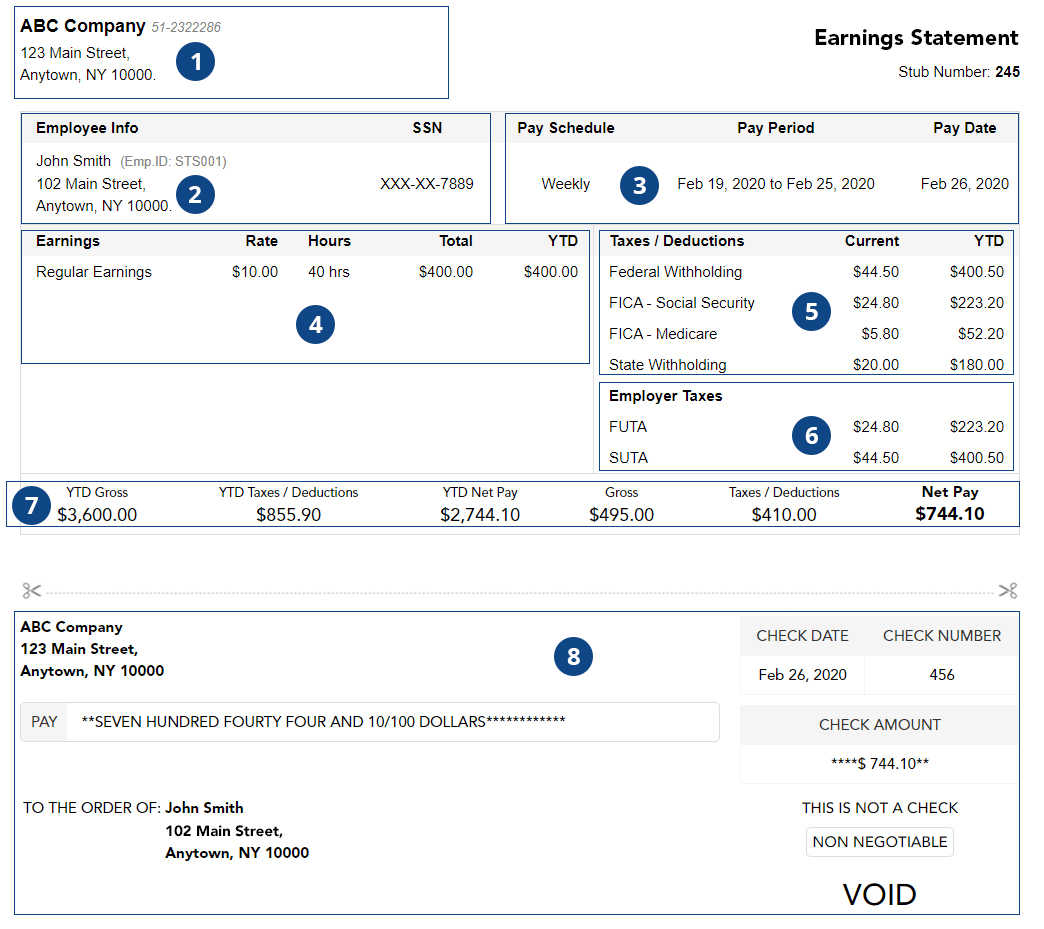

FICA would be Social Security and Medicare. Fit stands for federal income tax. Paycheck stubs are normally divided into 4 sections.

Visibility accountability and payroll compliance to name a fewEmployees should be able to see the kinds of withholdings and deductions their employers take out of their gross payAnd having it all laid out on the page can help employees and employers avoid unnecessary confusion or confrontation. Pay stubs are important for a number of reasons. However USPS pay stubs codes acronyms and abbreviations and what most employers use seem to bear many similarities across the board.

Your overall income helps determine the exact rate of your federal income tax. In the United States federal income tax is determined by the Internal Revenue Service. FICA means Federal Insurance Contribution Act.

Fica ficm fit sit tdi. Double-Check Your Pay Stub. A paycheck stub summarizes how your total earnings were distributed.

For a detailed explanation of each numbered section see the links below. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER which refers to an employers contribution if the employee receives a company match. The FIT deduction would only be stopped in the event of a death of an employee or if the employee files exempt status.

This is an important one to look at especially. FIT stands for federal income tax. Below you will find some of the most common deduction codes that appear on your pay stub.

More help with FIT withholding and payroll. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Click on ViewPrint All Pay Stmts at the bottom of the page.

A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. Your net income gets calculated by removing all the deductions. You will receive a pay stub for each pay period.

But when you are trying to decipher it all it can look pretty intimidating. It shows your total earnings for the pay period deductions from. Pay Stub Deduction Codes What Do They Mean.

FIT Federal Income Taxes. Fit stands for Federal Income Tax Withheld. Answer 1 of 2.

FIT deductions are typically one of the largest deductions on an earnings statement. The best way to do that is to review your pay stub and address any concerns. Some are income tax withholding.

On my paystub I have deductions listed as. In the united states federal income tax is determined by the internal revenue service. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket method for standard withholding.

FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. On your pay stub youll see some common payroll abbreviations and some that arent so common. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may.

Create A Pay Stub Payroll Template Birth Certificate Template Payroll Checks

Understanding Pay Stub Understanding Paycheck Stub

Paystub Excel Template The Spreadsheet Page

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Explore Our Sample Of Pay Stub Template For Nanny Payroll Template Templates Payroll Checks

Download Pay Stub Template 08 Payroll Template Word Template Paycheck

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Fillable Form Pay Stub Budget Forms Paying Paycheck

Create Pay Stubs Regular Pay Stub Professional Check Stubs Stubcheck Payroll Template Online Checks Regular

A Construction Paycheck Explained Example Pay Stub

What Everything On Your Pay Stub Means Money

With Free Pay Stub Generator You Can Make Free Paycheck Stubs And Can Get A Chance To Make 1st Stub Free Give It A T Payroll Template Templates Free Checking

A Guide On How To Read Your Pay Stub Accupay Systems

Hrpaych Yeartodate Payroll Services Washington State University